Pre-Owned Jewelry Market is Booming, Jewelers Should Get Their Share

Luxury goods are made to last, and the trend for purchasing pre-owned fine jewelry and watches has been on the rise.

The trend in the secondary market is growing for many reasons, among them an increase in online sales, changing consumer preferences, and rising concern about the sustainability of luxury goods, particularly among younger consumers, finds the Boston Consulting Group (BCG). These trends were well underway before COVID-19 hit, but the pandemic, and the economic slowdown it created, has accelerated them.

Published September 2020, BCG’s report on the hard luxury market shows that the market for secondhand hard luxury items, primarily watches and pre-owned/estate jewelry, is worth over $22 billion worldwide and growing annually at 8%, which is much faster than the luxury industry overall.

In a BCG survey of 12,000 luxury consumers from 10 countries conducted with Altagamma in 2020, 62% said they would consider buying a secondhand luxury item and 25% said they had made a purchase in the past year (with 18% of them buying watches and jewelry).

In the hard luxury category, watches account for about 75% of secondhand sales, and pre-owned/estate/antique jewelry makes up the remaining 25%, finds BCG. The secondhand watch market is well established. In fact, McKinnsey & Company, in its State of Fashion report 2021, describes the secondhand watch market as joining the mainstream, set to become the industry’s fastest-growing segment, reaching up to $32 billion in sales by 2025 (up from 18 million in 2019).

The market for pre-owned jewelry has lots of room to grow, creating enormous opportunities for jewelers to proactively shape demand and stake their claim.

Enormous Opportunities for Estate

BCG’s analysis reveals that secondhand sales do not reduce the purchase of new products. In fact, the management-consulting firm advocates that the right approach can complement the sales of new goods, reinforce a brand’s value, and give companies access to a critical group of future consumers that luxury brands and retailers should cultivate.

A key finding in BCG’s research is that consumers expect luxury brands and retailers to be involved in secondhand sales. Seventy percent of luxury consumers said they would prefer to buy secondhand products from luxury brands directly; 74% said they would like brands to certify secondhand products sold through resellers.

These consumers have clear expectations of how they want to buy secondhand luxury items like watches and jewelry, offering opportunities for forward-looking jewelers to provide the security, convenience and service they are seeking.

When it comes to estate jewelry — the term used to describe previously owned jewelry — a lot of it is not from the mainstream luxury brands. Moreover, most luxury brands do not have pre-owned or certified programs, and therefore it’s an opportunity for retailers to use their brand, expertise and relationships with their customers to provide the confidence consumers need.

Partnering for Success

Among a variety of case scenarios BCG shares for jewelry brands and retailers looking to expand their business in pre-owned hard luxury is to partner with an established player in the field that already possesses strong capabilities in areas such as assessing and pricing secondhand goods, marketing, and fulfillment.

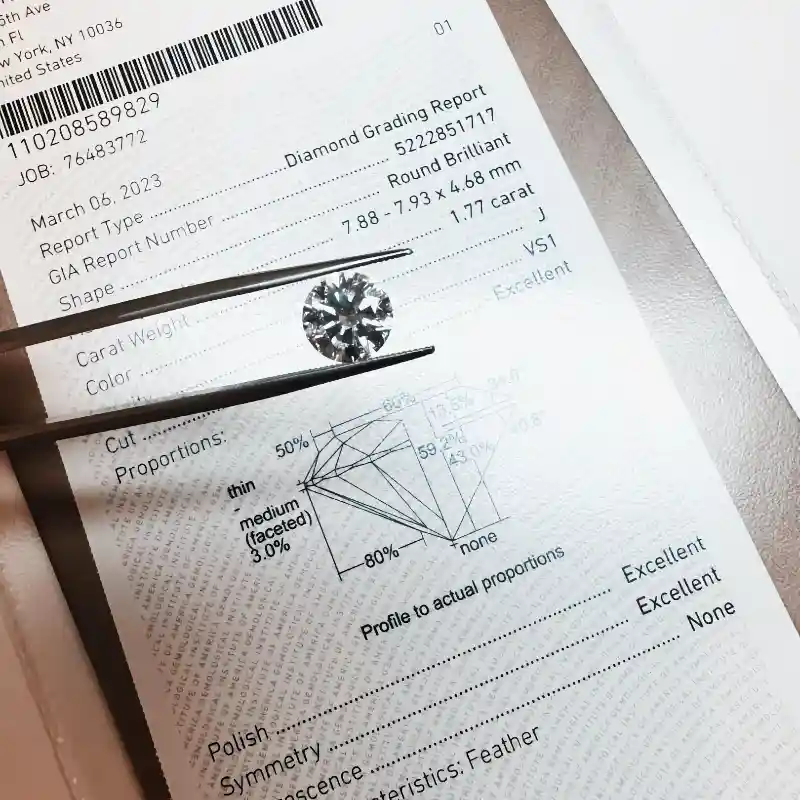

White Pine Wholesale, for example, serves as a trusted, experienced buyer and seller of estate jewelry, in addition to recycled diamonds, and can help jewelers navigate a variety of profitable opportunities to buy and sell pre-owned jewelry.

Among its services, White Pine can help jewelers buy from the public, in valuing gemstones and jewelry to make an offer. “As a leading recycler of diamonds and jewelry, we value items for more than the metal and/or breakout value,” explains White Pine CEO Benjamin Burne, “This allows us to offer higher prices than other jewelry and diamond buyers.” White Pine also can supplement jewelers’ pre-owned cases with certain styles to add a new revenue stream.

White Pine purchases pre-owned jewelry, both branded and unbranded, including engagement rings, earrings, pendants, necklaces, bracelets, and watches. Burne finds pre-owned jewelry prices especially advantageous relative to newly manufactured diamond jewelry with current diamond prices rising.

There is such a variety of merchandise available in estate jewelry, describes Burne. Most coveted are pieces from the Art Deco period, of which you can’t get enough. Currently, there are a lot of 1980s-style to more modern pieces available. Keep an eye on estate jewelry from the 1970s, particularly vintage charms, which the fashion platform Who What Wear expects will do well in 2022.

Shift in Mindset

Pre-owned, antique and recycled jewelry has rapidly gained momentum due to supply chain issues and a shift in mindset to shop for existing items, extending to engagement rings, ranging from buying vintage designs to custom creations made with reclaimed materials, reports the lifestyle platform, The Zoe Report.

Deirde Clark, a geochemist at Iceland GeoSurvey (ÍSOR), told TZR that secondhand jewelry and materials are the most sustainable option because of the environmental and social effects of mining and lab-created products.

“We live in a consumer society; buying new things perpetuates this. Reusing is an important method we can do to minimize this behavior,” Clark told TZR in an April 7 article, “Decoding Sustainable Engagement Rings, From Ethical Stones to Upcycled Metals.” TZR featured designer Valerie Madison and her Heirloom Diamond Rework service; and the label Kinn and its “KinnCycle” program that takes in 14K gold jewelry to recycle, offering $30 a gram in a Kinn gift card.

In the past, luxury brands and retailers could ignore the secondhand market, BCG reports, but today that is no longer true. Consumers are increasingly interested in secondhand hard luxury goods and have greater access to them than ever before.

Burne advocates that by expanding the estate jewelry category in their stores, jewelers can create compelling opportunities to add complementary sales, recruit new customers, and support sustainability agendas.