Lab Grown Vs Natural Diamond, One Has Resale Value, The Other Does Not

Demand for lab-grown diamonds has rapidly risen in the past five years, as consumers drawn to the idea of getting a bigger, better quality diamond for their budget are buying into a diamond product that has the same chemical and optical properties as natural diamond.

Claims by lab-grown diamond producers and sellers that a diamond is a diamond no matter its origin seem to suggest that diamonds made in a lab and naturally occurring diamonds are equal in all respects, including market value.

What consumers who have bought or might buy lab-grown diamonds may not know, is that if they decide to sell it back into the market, they will likely get nothing in return, as lab-grown diamonds have virtually zero resale value.

Diamond market analyst Paul Zimnisky, founder of Diamond Analytics, wrote in a 2020 opinion piece for the precious metals and mining news KITCO that the essential thing that sets a natural diamond apart from its lab-created counterpart is that it’s a non-renewable resource.

“The supply of natural diamonds is limited by nature and there is a value that the theory of economics ascribes to that,” writes Zimnisky. “This value is apparent in the secondary market for natural diamonds, and is why most of the prominent buyers of diamonds in the secondhand market only buy natural diamonds.”

Among those buyers that Zimnsiky mentioned is White Pine, a leading buyer and seller of recycled diamonds. Benjamin Burne, its CEO, says that no one is buying lab-grown diamonds in the secondhand market. “The reality is there is no resale market with genuine players for lab grown diamonds. At this point in time, natural diamonds are the only diamonds that embody lasting, verifiable market value.”

Declining Prices for Lab Diamonds

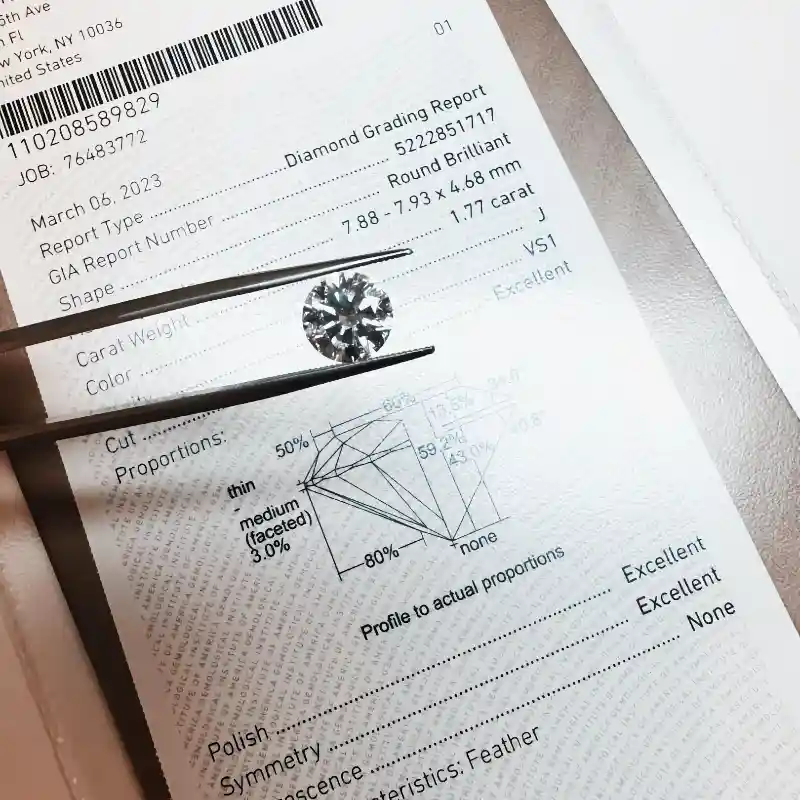

Despite increasing demand for lab-grown diamond jewelry, relative prices have steadily declined the past few years, due to increases in supply and improvements in quality, cites Zimnisky. He shares that in mid-2018, a generic 1-carat VS1-clarity, G-color lab-diamond retailed for $3,625 while a natural equivalent retailed for $6,600. Today, he says the same quality diamonds sell for $1,615 and $6,705, respectively.

The value of lab-grown diamonds is tied to the cost of production. Lab-grown diamonds are produced in factories in about two to three weeks using one of two methods, HPHT (high pressure, high temperature) and CVD (chemical vapor deposition) that artificially replicate the natural conditions that form diamond in the earth, forcing carbon atoms to crystallize. As technology improves, the cost of production declines, and so does the value of the product.

Diamond market analyst Edahn Golan, founder of Diamond Research & Data, sees the squeeze between technological advancement and retailer price reductions as the most impactful force dictating the future of the lab-grown economy. Wholesale margins were exceptionally large initially, he explains, but retailers wised up and demanded and got lower costs.

The decline in the average retail price per carat, translating into a lower average price per carat that retailers pay when buying goods, is resonating up the lab-grown pipeline. “In 2019, traders were talking of ‘84 back’, meaning an 84% discount from the Rapaport price list,” says Golan. “Today, a 95-97% discount to the list is far more common.”

Burne finds this in the telesales calls White Pine receives from lab-grown diamond sellers pitching their stock. “The prices keep going down. We now see un-negotiated prices of 94% back of Rapaport – down another 30% from before,” he cites. “Where will it end?”

Limited by Nature

Consumers buy diamonds partly because they perceive it as a store of value. Not solely because of value, beauty and style are a factor, but partly. They want something valuable, says Burne, they want something generational.

For thousands of years we have been fascinated with diamonds, drawn to the incredible durability and beautiful brilliance of this naturally occurring mineral, the hardest substance on the planet. It took billions of years, and extreme conditions of heat and pressure, more than 100 miles below the earth’s surface to crystallize carbon atoms into diamonds.

While the story of the technology able to replicate that in a factory within weeks is very cool, lab-grown diamond suppliers have no rules in place on how many diamonds can be produced and put on the wholesale market in a given time. Unlike lab-grown diamonds, natural diamonds have lasting value because the supply is limited.

The bulk of the cost for lab grown diamonds is profit margin, whereas buying a natural diamond the bulk of the cost is natural intrinsic value and that value will continue to grow over time, says Burne. In most cases, natural diamonds retain 50% or more of their initial retail value in the resale market.

Historically, the price of diamonds has appreciated over the years. In fact, the market price for natural diamonds has increased tenfold since 1960, and if these trends continue, natural diamonds will appreciate over time.

“Time has an impact in an inflationary environment. If prices appreciate at 10% a year over time you’ll be ahead in just a few years.” says Burne. He highlights that the supply of newly mined diamonds has peaked, with no new major mines uncovered for quite some time. At the same time, production for lab-grown diamonds continues to rise, and prices at wholesale and retail continue to fall.

“Will consumers realize en mass that they are being sold something that is worth very little? Will they care? Will there be outrage?” asks Burne. “When consumers start to re-evaluate the value of lab-grown diamonds, retailers will have to as well.”

Zimnisky supports a robust resale market for consumers, as one of the best ways for the natural diamond industry to demonstrate the value of its product. He does not envision such advocacy would unleash a flood of supply, as many people want to hold onto their diamonds. But he believes “a more readily available, competitive, and active diamond resale market would increase the secondary market liquidity for previously owned natural diamonds, which would support the market price of all natural diamonds, primary and secondary.”

Lab-grown diamonds may have the same chemical and optical properties as natural, but it’s important for consumers to understand up front that a lab-grown diamond they purchase today, will be worth pennies on the dollar a year from now.