- Home

- Quarterly Market Report

+1 (646) 569 3680Weekdays 9 AM - 5:30 PM EST

+1 (646) 569 3680Weekdays 9 AM - 5:30 PM ESTCheckout using your account

Checkout as a new customer

Creating an account has many benefits:

Welcome to the White Pine Quarterly Recycled Diamond & Jewelry Report. The purpose of this report is to give insight and visibility into the world of diamond recycling. 2020 was a year like no other. The global pandemic created supply disruption on one side and enhanced jewelry demand on the other, causing all of us to question our sourcing and bringing alternative sources to the forefront. In addition, environmental concerns and the enhanced politicization of these issues has focused attention on the circular economy. The resale revolution is ongoing and companies are plowing ahead with marketplaces in the luxury sector, but an equally important facet of the circular economy is materials recycling, a form of upcycling.

Not enough attention is being brought to recycling in the diamond industry, even though it has been going on behind the scenes for centuries. This report will shine a spotlight on recycling and provide important insights that will allow you to scale up the use of recycled diamonds within your business. We are always interested to hear from anyone and everyone who operates in the recycled diamond business, please feel free to contact us with your insights and anecdotes or simply to discuss an area of common interest. Enjoy the first recycled diamond & jewelry report!

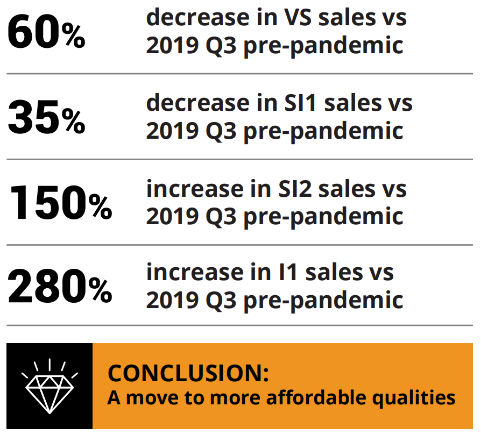

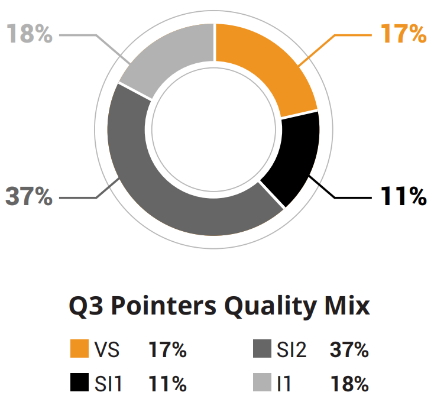

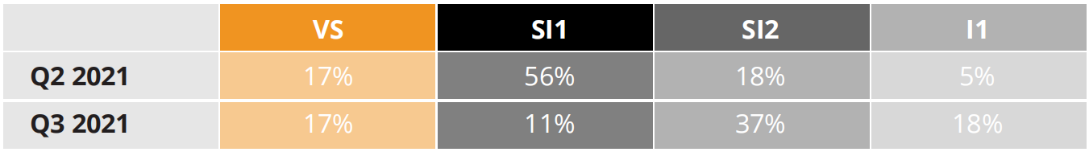

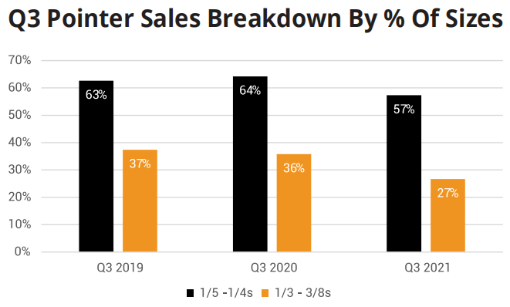

Notable shifts to SI2 and I1 between Q2 and Q3 of 2021

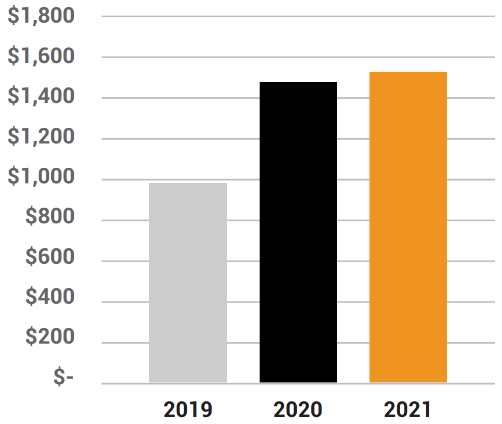

Average Q3 Diamond Sales Per Order

increase in transaction size from Q3 2019 to Q3 2021

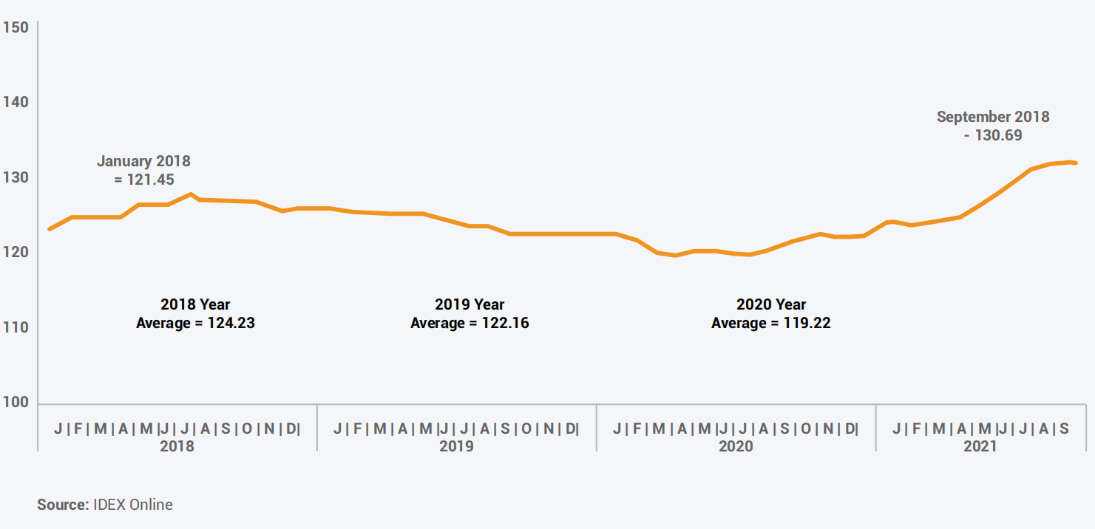

Click to view IDEX Online Polished Diamond Price Index

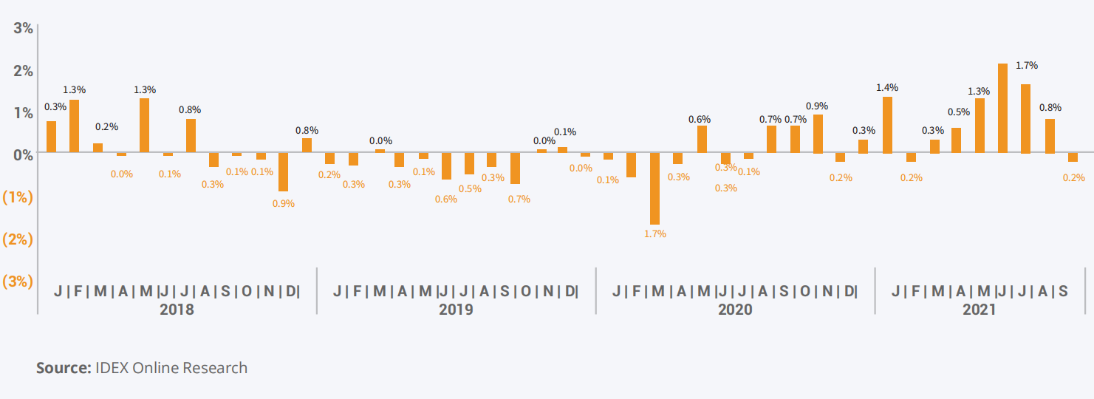

Year-on-year prices rose by 9.4% in September, slightly lower than the 10.3% in August. The percentage price increases had been rising steadily since January but dipped for the first time in September.

The Index remains at a six-year high in spite of two months of near-straight line prices. It has averaged 126.07 during the year to date, compared with 119.22 for the whole of last year, and 122.16 during preCovid 2019. The Index has been climbing, albeit with some volatility, since hitting a low point in April 2020, as the global pandemic struck. Before that it had been in overall decline since mid-2018. It bottomed at 117.96 in March 2020 when coronavirus first hit.

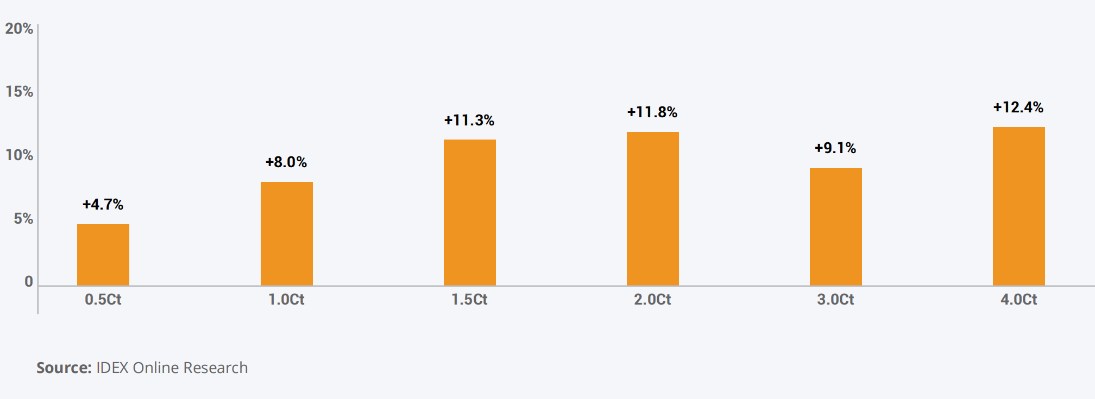

Year-on-year diamond prices were markedly up again in September, from a low Covid-hit base in 2020. Half-carats were up 4.7%, compared with 12.2% in August. Four-carats were up 12.4% compared with 6.7% in August. Price rises for all other sizes shown were largely in line with August.

Anything that can stack up on top of each other is increasingly popular. Bangles and rings that can be stacked. Thinner and lighter weight bangles, both with diamonds or with gemstones. Smaller, thinner bands either with diamonds, or diamonds and gemstones.

Simple and basic is the direction consumers and our industry is heading. Things like solitaire pendants both prong or bezel set, stud earrings, tennis bracelets, and hoop earrings. Other styles like the smile necklace, bar necklace or diamonds by the yard are also in demand. Another current industry trend is the paperclip style necklace. Drop earrings or earrings that hang off the ear are popular right now too.

Similar to the stackable trend with bangles and rings, consumers want to wear multiple necklaces at once. Multiple or adjustable length necklaces with simple styles, pairing either a Diamonds by the Yard, Bar Necklace, Smile Necklace, or Paperclip Necklace with shorter pendants like cluster pendants, bezel or solitaire pendants, heart shape pendants, or circle pendants.

Demand has slowed for the larger “statement” pieces. Now consumers want to be able to showcase multiple pieces of jewelry at once. This affirms the shift to more basic, stackable, and layerable styles. To achieve this, most consumers look to the more affordable price points when buying jewelry, and look to spend predominantly in the $500-$2000 range.

Demand for jewelry with yellow diamonds has steadily been decreasing. The once popular yellow diamond jewelry is now being replaced with basic jewelry styles with white diamonds and/or gemstones.

Diamond recycling isn’t new, in fact it’s been an important part of supplying the jewelry industry for many years. During this time we have seen companies starting to promote conflict free diamonds, recycled metals and lab grown diamonds, and in some cases defining their entire brands by using these products. What we haven’t seen much of yet is retailers marketing recycled diamonds directly to consumers and using that as a way to capture new consumers and market share. To us, it is the industry thinking inside the box and not understanding the new wave of Milenilal and GenZ consumers clearly enough. These consumer groups are completely comfortable with resale and recycling and are actively looking for brands and products that display sustainable credentials. It’s an open goal for retailers and manufacturers to work together and differentiate themselves from the rest of the market and to benefit from consumer sentiment.

The industry is currently experiencing strong demand across the board. We feel like this is the strongest diamond market that we've seen since 1999 or at least 2005. All sectors from retail to wholesale, manufacturing to mining are firing on all cylinders as are the different product categories from high end to low end, synthetic to natural. It is important that the industry enjoys this moment and builds up its collective balance sheet as this won't last forever. We don't want to be too negative because it is very hard to predict the timing of any collapse, and more money has probably been missed by being over cautious in anticipation of a crash than during the crash itself. So, as an industry, we must continue to push, invest and make money now. However, it is important to be cognizant of the fact that this can't last forever and be wise in our investments and not over-extend in advance of a slow down. It never hurts to think about what a future slow down could look like and what it will mean for the jewelry industry.

From the point of view of diamond supply, the delicate balance of supply and demand was disrupted by the pandemic. The initial government induced shut-down on consumer demand caused diamond prices to collapse and production to halt or dramatically slow down. This, combined with the difficulties of operating in the pandemic and the intermittent shutdowns in production centers, reduced supply which then could not keep up with the resurgence in demand that happened once the economy reopened. However, diamond production is ramping up in all areas. Miners, lab growers and production centers are scrambling to meet the elevated demand. Whether the current demand is reflective of future demand or more of a satisfaction of pent-up demand combined with macro factors will play a large part in determining future diamond prices.

We would imagine that it is quite likely that demand will drop off as government stimulus fades and interest rates rise and then at that time the industry will be in a position of oversupply and sales will become harder, with financial obligations to be met and diamond prices will swing back the other way towards their long term natural equilibrium. This is not the only possibility though. It is conceivable that sustained inflation could cause a systemic shift in diamond pricing to a new level, a new normal, with higher diamond prices throughout. Or it is possible that the seemingly inevitable expansion of lab grown diamonds will take market share from natural diamond products putting some downward pressure on natural diamond prices. The future is unknown, but for now we believe that the likely scenario is that coming into the 2nd and 3rd quarters of next year, the pendulum will swing back the other way and an oversupply of natural diamonds will start to show itself as supply catches up with demand and demand slows down as stimulus fades and interest rates slowly rise. Whatever happens, the industry will still thrive. Demand is strong and seemingly bounces back resiliently from the greatest of set-backs. The start of the pandemic was an intimidating time for many, but with sensible business growth there is no reason to fear the future.