- Home

- Quarterly Market Report Fourth

+1 (646) 569 3680Weekdays 9 AM - 5:30 PM EST

+1 (646) 569 3680Weekdays 9 AM - 5:30 PM ESTCheckout using your account

Checkout as a new customer

Creating an account has many benefits:

What a fourth quarter and year that turned out to be. Based on anecdotal evidence from customers and friendly competitors, the industry, for the most part, had a great year. Since I started in the trade in 1997, I have not known the industry to be in such a robust and positive state with every participant seemingly happy! Positive sentiment is tremendous for the industry, success breeds success. The increase in jewelry sales is its own form of advertising. People see their friends buying and wearing and are thus inspired to buy for themselves. However, good times don't last forever and the industry should ride this wave as long and as best it can. It must build up its balance sheets and collective financial strength to be strong for many years to come.

The recycled diamonds segment was no exception, performing very strongly in Q4. Prices were up in the secondary market and goods were transacting at auction with a 15-30% premium compared to previous quarters. Based on that, now is an extremely advantageous time to sell off or re-purpose accumulated diamond stock. Read the full report for a detailed breakdown of data and trends in the recycled diamond industry. Aside from the strength of the secondary wholesale market (which demonstrates the strength of the diamond industry within the trade), we continue to see an ever- increasing demand from retailers and consumers, specifically asking for recycled diamond. We were delighted with the interest and discussion that the first quarterly market report generated and we look forward to receiving even more comments and feedback this time around. Enjoy the recycled diamond & jewelry report!

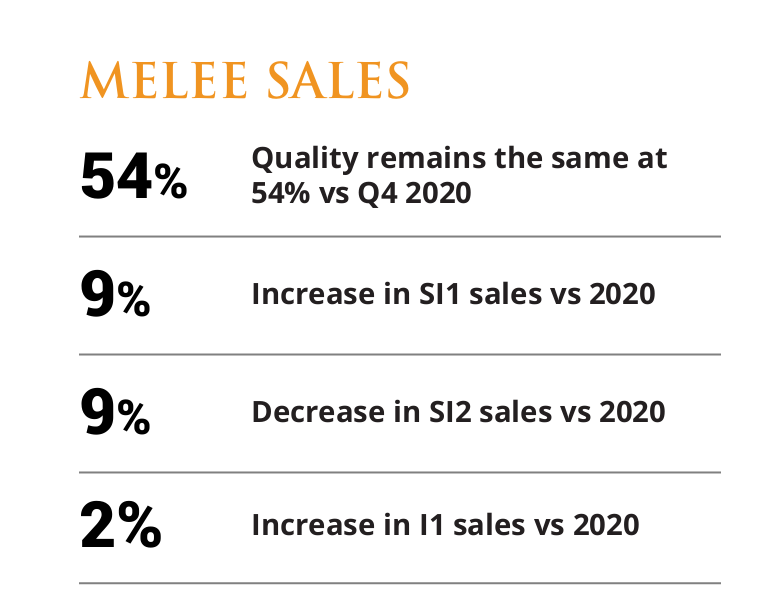

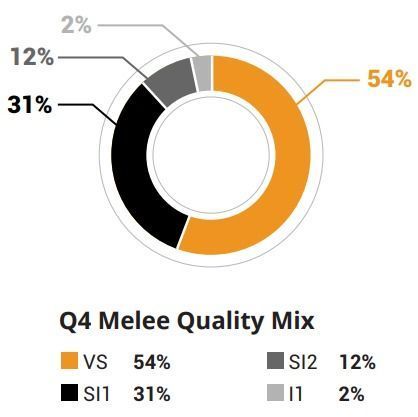

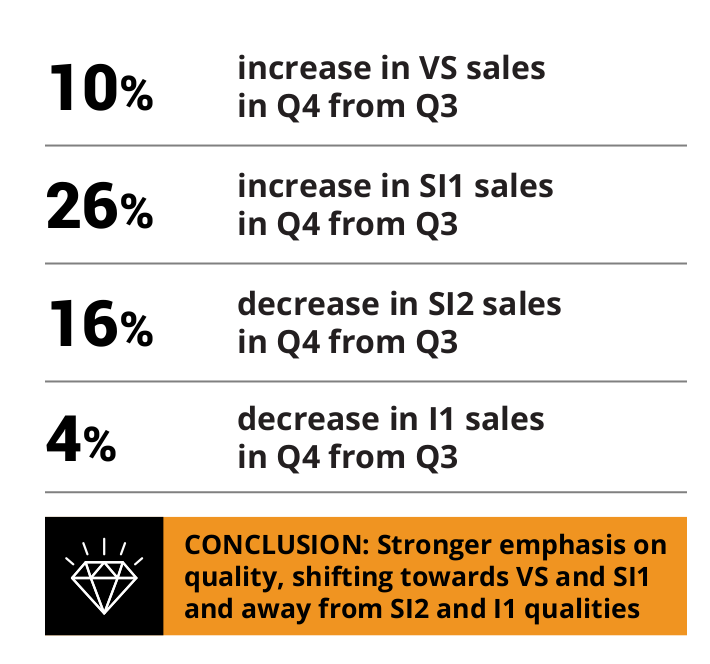

CONCLUSION: Stronger emphasis on quality, shifting towards VS and SI1 and away from SI2. Higher emphasis on maximizing return and repurposing recycled diamonds, 50% less closeout diamond sales vs 2020.

Notable shift towards premium clarities between Q3 and Q4 of 2021

Average Q4 Diamond Sales Per Order

increase in transaction size from Q4 2020 to Q4 2021

Click to view IDEX Online Polished Diamond Price Index

Compiled by Hennig from a number of proprietary & public sources; includes data to 26th January 2022.

We’ve seen the shift from larger statement pieces to more of everyday wearable styles at lower price points. Consumers want to feature multiple pieces in their everyday style whether it is layering necklaces, wearing multiple earrings, or stacking rings or bracelets. And they want to do this without breaking the bank. We saw a majority of our business in Q4 was for items $1,800 or less. In fact, items costing $1,800 or less made up 77% of all our essential diamond jewelry items sold in Q4.

Demand for simple and basic diamond jewelry styles remained strong through Q4. Styles like solitaire pendants, bezel and prong set studs, diamonds by the yard, stackable bands, and tennis bracelets all finished the year with strong sales. Something they all have in common is how easily customizable they are. Simple styles generally allow for easy customization which can then reflect the price points customers want to pay.

We've seen a growing popularity in earrings that hang/dangle off the ear. The new styles we introduced to the market in the 2nd half of 2021have done very well. Our bezel drop earrings and diamond by the yard drop earrings are simple, stylish and most importantly, affordable. Drop earrings sold the 5th most units in Q4.

Wearing multiple pieces together, specifically the trend for layering necklaces continued in Q4. Layering works perfectly with items like diamonds by the yard, bezel pendants, smile necklaces, paperclip necklaces, and tennis necklaces. It's no surprise we noticed a surge in necklace sales in Q4.

Anything consumers can stack up on top of each other is selling strongly. Wearing multiple bangles and tennis bracelets or multiple rings as a set. Q4 saw the shift away from larger, chunkier pieces to smaller, thinner, sleeker bands and bracelets with diamonds and gemstones.

In almost every industry, businesses are emphasizing sustainability and social responsibility as consumers prioritize these issues. It is now a successful business strategy to have options to satisfy customers that are actively adjusting their spending priorities.

Millennials will make up 50% of luxury sales by 2025 (1), and Gen Z shoppers already account for nearly 10% of the market. Couple this with data suggesting that 73% of Gen Z consumers surveyed were willing to pay more for sustainable products (2), more than every other generation, we can see an opportunity now and in the future.

Recycled diamonds are the most sustainable diamond currently available, giving them a significant sales advantage over other sources of diamond. For those of us using these diamonds, it is important to drive awareness and keep educating our customers on their features and benefits.

There are simple low risk ways that you can offer recycled or reclaimed diamonds to your customers. For example, you could offer to make your custom engagement rings completely from recycled diamond. Have this option available and let the customer decide. Your recycled melee and center stone can be available the next day. If you want to start even smaller, just offer the side stones as recycled, present the facts and see who’s interested. However you start, you will stand out from competitors and build brand awareness by developing marketing strategies that include sustainable messaging and education.

1 - https://www.luxurydaily.com/how-luxury-brands-can-win-gen-z-and-millennial-shoppers/

2 - https://www.firstinsight.com/white-papers-posts/gen-z-shoppers-demand-sustainability

Sustainability - Everyone in the industry is talking about sustainability and preaching about their sustainable credentials, but as we all know, recycled diamonds are the number one choice when it comes to this!

Inflation - Owning stock is back in style!?! After more than a decade of industry de-stocking, with every consultant recommending faster inventory turn, suddenly it pays to own stock. Inflation expectations are high and what will it take to slow this down? Will it last or will it not? Diamond Intensive - Diamond intensive pieces are selling. There is a lot of interest in cuban link chains and Joe Burrow style neck pendants.

Space - Seems to be the new hot trend. It's in the news everywhere, from the 555.55 carat black "possible" meteorite diamond to Diana Rae Jewelry sending Diamonds to space with NASA. How do we, the masses, get a piece of the final frontier!

For now, the path of least resistance for diamond prices is up. The miners are determined to extract as much per carat as possible and suppliers are getting into a cycle of implementing higher prices, it is becoming the normal. Combine this with a 24/7 news cycle reminding us about inflation and the shortages that remain in the marketplace, higher prices are likely in the short term. There does not seem to be any looming oversupply or stock issues in the pipeline that could cause a natural slowdown to this dynamic. DeBeers has forecast increased production for the year, but it will take a while for this to flow through the pipeline and replenish all shortages. The US consumer is still buying strongly and there seems to be more issues with shortages than oversupply. Thus, it will take some time before reaching a new balance between supply and demand. As always, any forward-looking statement is uncertain, but I believe there would need to be some kind of black swan event to de-rail these price increases and cause a correction. This could take on one of many forms, a war with Russia springs to mind, but anything is possible.

Over the medium term the rise in diamond prices is likely to push more and more consumers into alternatives, such as lab grown diamonds. Whether they ever return to the natural product remains to be seen, but ultimately demand may reduce. This reduction in demand combined with the mining and production increases will ensure that we will reach a natural price peak at some point. In my estimate, this has a higher probability of occurring in the second half of the year. Recently we have seen a sustained sell off in other risk assets like stocks, crypto and bonds, this is seemingly a reaction to the tightening of the Fed and there is a risk that this contagion may spread to commodities and diamonds. However, the economy is still strong and diamond prices did not increase in the way that the crypto and stocks have. Hopefully, that will keep diamond prices protected through this period. This is an interesting and exciting time in this industry and I, for one, am looking forward to 2022. I hope that you are too and that you enjoy a strong and successful year!

All forward-looking statements are management’s present expectations of future events and are subject to a number of factors and uncertainties that could cause actual results to differ materially from those described in the forward-looking statements.